The cost of doing business in college athletics has never been higher, and athletic departments are more keen than ever to spend record amounts to hire and fire football coaches amid uncertain economic times.

Coaching salaries have exploded, buyouts have gone nuclear and “guaranteed money” has become the sport’s favorite word over the last decade, leading to a rise in fully guaranteed contracts for coaches, even though most never sniff the end of their multi-year contracts before being shoved out the door “without cause” for the unforgivable sin of losing. Meanwhile, the enterprise is buckling due to the introduction of revenue-sharing with players this fall (upwards of $20.5 million) and increasing expenses.

At what point does the well dry up?

“Even though the math doesn’t seem to math,” said one search-firm executive who helps programs find coaches, “athletic departments always find a way. And until they stop keeping score or people stop caring, I guess they’ll find a way to do it.”

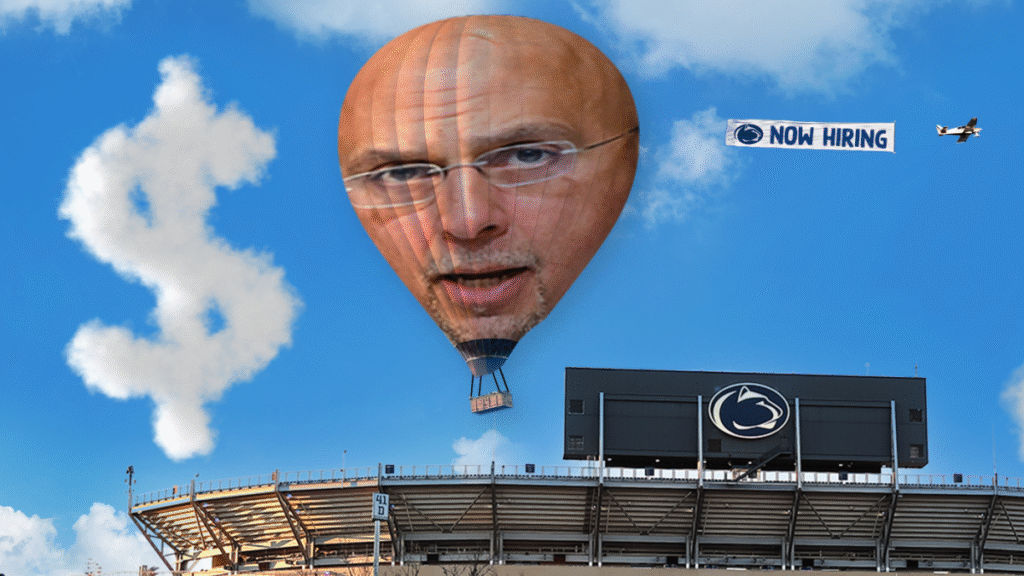

The latest firing sent shockwaves across the industry: Penn State coach James Franklin, gone just nine months after steering the Nittany Lions to the playoffs. His parting gift of $49 million ranks as the second-largest buyout in college football history. His replacement could carry a hefty pricetag, too.

Big-time college athletics has always been a zero-sum hustle. They spend as much as they earn — and many spend more than they bring in. Twenty-two athletic departments cleared at least $150 million last year, and many barely broke even. Thirteen head coaches are set to make at least $9 million this season, nine of them crossing the $10 million mark. Most of their contracts guarantee at least 85% of the remaining money on their multi-year deals if they’re fired, with some deals stretching as far as 10 years.

Sound insane? It is.

“In theory, there’s more incentive to not win games and then get fired, so you don’t have to come to work anymore. That’s so backwards,” an executive at a search firm assisting schools told CBS Sports.

Like the sport itself, college football’s coaching economy is a distinctly American creation — part capitalism, part fantasy football.

“Winning is the only thing that really matters in college sports, and for that reason, college sports is the only industry in America where the cost of doing business defies every rule of sound business management and financial stewardship,” said prominent sports attorney Tom Mars, who once sued a school seeking buyout money for a coach. “There is no limit to what wealthy donors will donate to college sports programs; and coaches and their agents hold all the cards when a school becomes fixated on hiring them.”

Emotions have replaced business sense, and powerful agents know it. They’ve weaponized fear of losing a coach, of falling behind to drive the market skyward.

Texas A&M set the modern standard for excess when boosters lured Jimbo Fisher from Florida State and, terrified he then might bolt for LSU, handed him a fully guaranteed 10-year contract. By the time A&M fired Fisher, he was paid the largest buyout in college football history: $76.8 million.

“ADs answer to the president, the president answers to the board and the donors are always involved at these schools,” said Chad Chatlos, managing director for TurnkeyZRG, a firm assisting college coaching searches. “Sometimes the wrong people are influencing the process to extend or let go of a coach. I give the agents a lot of credit. They have created a sense of fear around the potential of having a coach leave.”

The Buyout Bubble: Why college football keeps paying millions to make coaches disappear

Brandon Marcello

For athletic directors, one bad hire can end a career. Reputation is the currency. That’s why, as one search-firm executive put it, “It’s not the president or board’s money. If a president, board and AD make an elite hire that turns the program around, no matter what it costs, that’s going to help the public’s perception of their ability to do their jobs.”

Said an ACC athletics director: “I’m not sure schools have that much bargaining power if they identify somebody they really, really want that gets everybody excited. The agents know it, the coach knows it and they’re going to try to get as much guaranteed money as they can.”

Rising costs haven’t yet slowed the money train, but the introduction of revenue sharing and schools paying record buyouts to change coaches this season could reset how contracts are negotiated. Still, many in the industry have their doubts.

Thirteen coaches across the Power Four would pocket at least $50 million if they were fired today. Four of them — Kirby Smart, Dabo Swinney, Dan Lanning and Curt Cignetti — have fully guaranteed contracts.

What happens when those same coaches leave for another job? The schools get pennies on the dollar. Smart would owe Georgia just $5 million. Cignetti, a rumored Penn State target, only $10 million after Dec. 1.

College football head coach salary rankings: Overpaid, underpaid and Kirby Smart’s gobsmacking buyout

David Cobb

There’s also the buyout money schools owe to multiple assistant coaches, which could eclipse eight figures.

Athletics director Pat Kraft hints Penn State’s next deal will look different because of the changing landscape of NIL and revenue sharing, but with rich boosters propping up the program, they’re better positioned than others.

“When all these contracts were signed, the use of the money going to rev share and all the other pieces that are involved (were not in place),” Kraft said. “You have to process the financials in such a different light.

“And so, quite honestly, when you get into a search and start to have those hard conversations: What do you envision this program? How do you envision the program looking? How do you envision winning a national championship? I mean, the facts are the facts. You’ve got to recruit at a high level. And now the transfer portal – you have to be able to recruit in the transfer portal at a high level. So how do you use your resources in the right way, building a roster that can compete for a national championship?”

One potential tweak could be to implement more incentive-based contracts for coaches across college football, especially for programs aiming to invest more into revenue sharing and NIL contracts to attract top-tier players. Perhaps shorter terms with higher yearly salaries are an option, sources told CBS Sports.

“So many people in this industry don’t want to be the first to adapt because if they’re wrong, then they’re fired,” an agent who represents college coaches told CBS Sports. “ADs and people in this industry make decisions for many different reasons, and quite often it’s not based on merit.”

How did we get here? Slowly, and then all at once.

The first fully guaranteed contract is believed to have been signed in 2007, when Texas A&M hired Mike Sherman and signed him to a deal worth $12.6 million over seven years. Ten years later, the Aggies pushed the envelope again with Fisher’s initial 10-year deal worth $75 million, which increased again in 2021.

Michigan State normalized fully guaranteed contracts in November 2021, when it renewed then-coach Mel Tucker with a 10-year deal worth $95 million. At the time, it was the third-largest contract ever.

“That was an inflection point because around the league you looked at the coaches who had already been successful and they’re like, ‘Whoa, wait a minute!'” a Big Ten athletics director told CBS Sports. “It just reset the whole market.”

That same month, Penn State signed Franklin to a new 10-year deal, similar to Tucker’s structure at Michigan State, despite holding a 7-4 record heading into the final week of the regular season.

The market was reset.

🏈 💰Most Expensive Buyouts (as of Dec. 1, 2025)

1

Kirby Smart

Georgia

$105.1 million (100% of salary through 2028; 85% after 2028)

$5 million

2

Lincoln Riley

USC

$80+ million*

N/A

3

Ryan Day

Ohio State

$70.9 million (92%)

$6 million

4

Mario Cristobal

Miami

$61 million*

N/A

5

Kalen DeBoer

Alabama

$60.8 million (90%)

$4 million

6

Steve Sarkisian

Texas

$60.3 million (85%)

$6 million

7

Dabo Swinney

Clemson

$60 million (100%)

$3 million

8

Mike Norvell

Florida State

$58.67 million (85%)

—

9

Dan Lanning

Oregon

$56.73 million (100%)

$20 million

10

Curt Cignetti

Indiana

$56.7 million (100%)

$10 million

*Reported figure; contract not publicly available from private university.

The past paves the future

Five years ago, the coaching carousel seemed destined to stall.

College sports were in turmoil. A pandemic gutted budgets, canceled seasons and shuttered some Olympic sports.

Luckily, college football kept many athletic departments afloat. As a shortened season kicked off in the fall, it was believed most head coaches would be given a mulligan amid the strangest and most challenging season in the sport’s history.

“I remember talking to people and thinking there’s not going to be any changes because there’s no money,” an executive with a search firm told CBS Sports. “Then South Carolina fired Will Muschamp and paid him $15 million or whatever it was. Everybody was like, ‘Well, shoot, if they can figure out how to do it, I guess we can, too.'”

And just like that, the dam broke again.

Muschamp was fired in mid-November at a price tag of $12.9 million. Auburn handed Gus Malzahn $21.4 million, which was then the largest buyout in college football history (it now ranks third).

If a pandemic couldn’t stop the money machine, maybe revenue sharing will. But history says otherwise.

“I have said for years that I thought coaches’ contracts would level out,” a Big Ten athletics director said. “And I’ve been dead wrong. They continue to go in the other direction. I don’t want to say it’s laughable, but I guess it kinda is. We’ve got the good aspects of pro sports in terms of big money, but we’ve got all the negatives that pro sports don’t have. There are no guardrails.”

🏈 💰Most Expensive Buyouts in College Football History

1

Jimbo Fisher

Texas A&M

$76.8 million

2

James Franklin

Penn State

$49 million

3

Gus Malzahn

Auburn

$21.4 million

4

Charlie Weis

Notre Dame

$18.9 million

5

Willie Taggart

Florida State

$18 million

6

Ed Orgeron

LSU

$16.9 million

7

Tom Allen

Indiana

$15.5 million

8

Tom Herman

Texas

$15.4 million

9

Bryan Harsin

Auburn

$15.3 million

10

Art Briles

Baylor

$15.1 million

The power agents still dictate the terms

Behind the curtain, agents pull the levers. Names like Jimmy Sexton and Trace Armstrong dominate the carousel, orchestrating bidding wars that leave ADs playing checkers against grandmasters.

“There’s not another industry that has 30 jobs open at the same time with similar candidates. That’s where the leverage comes from,” a search firm executive said. “There’s urgency to make a hire, there’s an overlap in candidates and four or five agents control 80% of the market.”

Hidden costs lurk behind every coaching change. There’s the five- or six-figure fee to hire a search firm, a ballooning salary pool for assistants and the inevitable construction of new support staff, all adding layers to an already bloated operation.

Then come the buyouts nobody talks about. Sitting head coaches often owe money to their former schools, but those checks are usually covered, directly or indirectly, by the new employer. Some even come with interest attached. When a contract requires a coach to pay the school himself, the new school typically floats the cash and tacks on roughly 30% more to cover taxes, turning a buyout into a fully financed handoff, an executive told CBS Sports. (Miami paid Mario Cristobal $14.9 million to offset his $9 million buyout at Oregon in 2022).

As of mid-October, six major programs are officially in the market for a new head coach. More are expected to join them in what insiders believe could be a record-setting carousel. Many schools quietly make in-season moves by hiring search firms, charting candidates, and running mock scenarios to gain an early jump before rivals can strike.

“There are schools out there that know they’re firing someone but they just haven’t done it yet,” one search firm executive said. “You live in fear, but you’re preparing right now because you don’t want to get to the end of the season and you don’t have a really good idea of where you could go and where you’re sitting. It’s a big chess game, and it’s difficult.”

That chess game, though, may finally hit a breaking point. With NIL and revenue-sharing costs climbing, some administrators whisper about pulling the reins on runaway buyouts, but few believe it will stick.

“It’s going to take a lot of time,” said an ACC athletics director. “Who’s going to be the huckleberry?”

“There’s going to be an attempt to call these things back. I mean, you almost have to be willing to call the coach or agent on whether someone’s going to leave or not, right?” Chatlos said. “I know we like this guy, we don’t want to lose him, but we can’t mortgage the future of the university for eight to 10 years because we don’t know what’s going to happen in three years.

“Penn State’s a great example, but think about this: if (Franklin) didn’t already have that 10-year contract, and he was on a three- or four-year deal when they went to the playoff last year, what would have happened? They likely would have redone his deal, and now that buyout number would be even bigger.”

The toothpaste is already out of the tube. The only question left is whether any athletic director in America has the nerve or the leverage to try screwing the cap back on.