There were big stories in 2019 that look up a lot of oxygen. Brexit was one example as the U.S. hurtled toward a no-deal position with the European Union, and what impact would that have on travel? (It was largely OK in terms of ripple effect, but there were some logistical bumps for sure.) There was considerable momentum behind certain

technological innovations—some that would endure (machine learning) and some that would not (a blockchain-based distribution concept called Winding Tree). A

couple of storylines, however, that initially seemed like anomalies, were early

signs of deeper problems that would play out over time.

The overriding characteristic for business travel in 2019

may have been the palpable confidence in the industry itself. The BTN Corporate

Travel 100 was spending at higher levels than ever. As a group, the top 100 companies

spent more than $11.8 billion in U.S.-originating air spend, the metric by

which that annual BTN list of big corporate travel spenders is compiled, with

companies like Deloitte, IBM, PWC and EY solidly in the top 10, while Amazon

and Google had leapfrogged to new prominence in that arena as well.

U.S. airlines in 2019, according to the U.S. Bureau of

Transportation, spiked profits by 25 percent over 2018 and was on a seven year

streak of consecutive earnings increases. STR reported the highest performance

ever for the U.S. hotel industry, with supply reaching 1.9 billion available

room nights that year, and demand clocking in at 1.3 billion room nights. Though growth rates had slowed from previous

years, the industry remained on an upward trajectory and continued to reach

historic highs year on year.

Agencies and corporate travel technologies were pursuing

innovation as well. BCD Travel released its SolutionSource Developers Hub,

which many industry observers looked at has a major step in the right direction

for third-party technologies to finally get more deeply integrated through corporate

travel gates. Midmarket agency ATG Travel was collaborating with IBM Watson to

create a new booking experience that incorporated machine learning and “automated

reasoning,” which we might now call artificial intelligence.

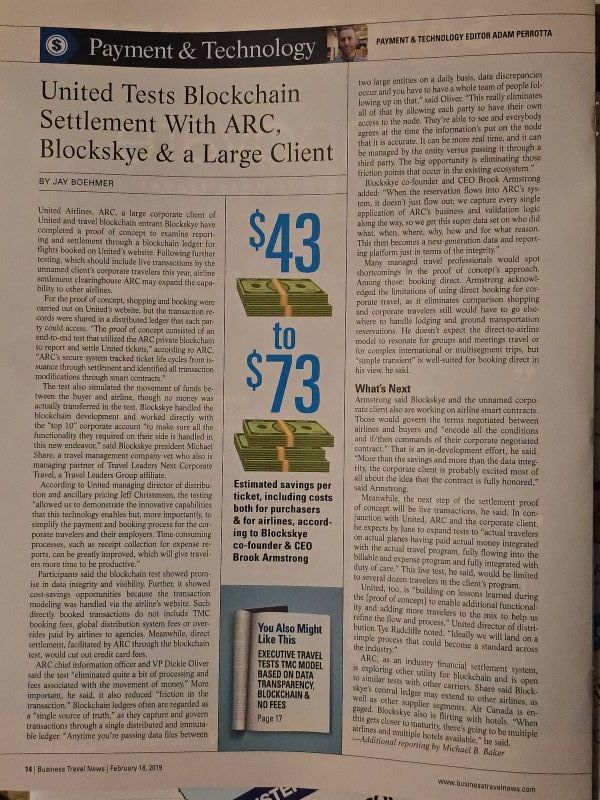

A collaboration between United Airlines, ARC, a blockchain-based startup called BlockSkye and a confidential “large corporate” began a direct booking effort with blockchain-based ledger for payment reported its first successes. The teamwork would turn into a much bigger story by 2023, with the large corporate ultimately revealed as PWC and a new player Kayak for Business getting into the mix. But the seeds were planted in 2019.

A bigger headline at the time was airfare

filing company ATPCO pushing its Next Generation Storefront standard. It worked to reconcile via an ATPCO algorithm what had become

proliferating branded fare types into a comparison display for agencies and

booking tools that organized such fares along like-for-like attributes.

NSG ultimately would take a backseat by 2021, though its

imprint would be seen on Sabre’s 2021 Sabre Red 360 agency desktop rollout. But

in 2019 NSG proved a flashpoint, with a major booster in Delta Air Lines which leveraged

its influence to “force” certain players into incorporating the standard into

their booking displays. TripActions (now Navan) was the poster child for a

public exhibition of this kind of pressure campaign, when Delta pulled its

content from the startup agency because its display failed to adapt to the

emerging standard. TripActions took a month to revamp its flight tools into a configuration

that would meet Delta’s requirements. By the end of 2019 several emerging

booking players—largely those that served small and midmarket clients—were falling

into line, given the possibility they might lose content from a major player if

they didn’t.

Concur was an outlier here—and one that would soon enough be

called out publicly on a BTN webinar by Delta’s Jeff

Lobl as “one large booking tool” that was in need of “modernization.”

Indeed, Delta

had a hand in advising on Concur’s T2 platform that rolled out in 2023.

Dark Skies Brewing for the Industry

If NSG stirred any real controversy, it was in the service

of industry innovation. There were more serious issues brewing in the travel

industry, in corporate travel organizations and more broadly in the larger context

of travel that would have repercussions beyond their initial appearances.

Boeing 737 Max – In October 2018, pilots for Indonesian

carrier Lion Air, which was among the first airlines to take delivery of the

Boeing 737 Max just a year earlier, lost control of a 737 due to what would be investigated

as a failures in the plane’s flight control systems that forced the nose of the

plane downward at high speeds and made it impossible for pilots to take over

manual control. The resulting crash of Lion Air 610 into the Java Sea shortly

after takeoff killed 189 people. A second crash on Ethiopian Air 302 in March

2019 resulted from the same malfunction and killed 157 people. The Boeing 737

Max was grounded worldwide until December 2020.

United Airlines, Southwest Airlines and American Airlines

all had grounded Max fleets that impacted their capacity and growth plans for

2019. By 2020 those growth plans would be off the table for other reasons. But

airlines throughout 2019 announced and pushed back re-introduction dates for

their Max fleets as confidence levels for the model cratered.

Boeing CEO Dennis Muilenburg resigned. He was replaced by

David Calhoun. It would take five more years and whistleblower disclosures to

discover multiple lapses in testing and safety processes at Boeing were underpinning

Max 737 failures. Problems re-emerged in 2024 with a plug door blowing off an

Alaska Air plane midflight, again putting Boeing under scrutiny, torpedoing its

stock price and undermining confidence in the company. Calhoun resigned in 2024.

He was replaced by Robert Kelly Ortberg.

Major European manufacturer Airbus surpassed Boeing in sales

in 2019. Though the safety records of the two manufacturers are similar, Boeing’s

high-profile incidents in 2019 and 2024 influenced safety perceptions for

travelers and the industry.

Association Leadership Controversies – Association

leadership decisions can prove controversial even in the best of times. Members

will have different views of who should be in charge and the direction of the

organizations themselves. BTN ran a single story in 2019 that aired apprehensions

and criticism toward executive search efforts and appointments for both the

Global Business Travel Association and the Association of Corporate Travel

Executives that year, and the lack of transparency in how the organizations

arrived at their final choices.

ACTE chose board president Leigh Bochicchio to lead the

organization into what would prove to be the organization’s final year.

However, Bochicchio until the final weeks of the search was a member of the

executive search committee. The individual who would most directly benefit from

Bochicchio’s advancement into the leadership role was also on the hiring committee.

While the organization claimed it had executed a full-fledged executive recruitment

process with an outside firm, the choice left many observers clamoring for more

transparency.

GBTA did not execute a full recruitment process for its open

leadership position vacated by Mike McCormick, and perhaps more than the ACTE

appointment raised hackles among members by hiring longtime industry firebrand

and GBTA Allied Leadership Council president Scott Solombrino as executive

director.

It was an internal-hire move criticized in general in a BTN

report by a seasoned association management consultant, and according to a veteran

buyer member of both ACTE and GBTA had stirred up acrimony to the point of distraction

from other critical industry issues. The Solombrino hire would prove disastrous

for GBTA in the coming months; at a time when visionary leadership would be

crucial, the organization would be left in crisis communications mode. ACTE

would shutter its organization as it reeled in the early days of the Covid-19

pandemic when it was forced to cancel its annual convention.

Mysterious Pneumonia Reported in China – BTN didn’t

cover the pneumonia-like illness spreading in China until January. But word of

fevers and respiratory disease of an unknown origin had spread into some mainstream

media by very late December, after being investigated by the Chinese health

authorities in the final days of 2019. Airports in China and surrounding countries

began scanning arriving and departing travelers for fever by the first week of

January and by January 31, U.S. airlines would cancel flights to China as would

airlines around the globe in an effort to contain the spread of what had become

known by then as Covid-19.

It’s arguable that no single topic will ever have more dedicated

ink in BTN than did the Covid-19 pandemic, as it shut down travel operations

around the world, isolated and stranded business travelers away from their

homes and, once returned, kept them at home for the better part of two years.

All of that ink would wait until 2020. Covid’s origins,

however, are tied to December 2019, when airlines, hotels, TMCs, business

travel associations and travel managers all were projecting a strong trajectory

for business travel in the months ahead, despite headwinds in terms of

uncertain trade relationships—particularly between China and the U.S.—and the

pending reality of a no-deal Brexit as well as other geopolitical and economic

tensions.

.png)

JANUARY

British Airways tests expanded fare options on Boston and Dubai routes, available

mainly through direct and NDC-enabled channels, to raise pricing flexibility

and compete with low-cost carriers.

Carlson Wagonlit Travel reluctantly pilots access to Lufthansa’s lowest fares via aggregator Travelfusion

after the airline removed these fares from GDSs. CWT sees the move as a

commercially motivated channel shift that creates inefficiencies.

Delta Air Linespulls its content from the TripActions booking platform,

saying that the platform did not meet the carrier’s display requirements. Soon

after, TripActions unveils a new flight booking platform endorsed by Delta that allows

travelers to easily compare and book flight options.

TripActions works together with payment tool Divvy to

integrate travel booking and expense management.

New Zealand-based Serko grows its North American

footprint by acquiring U.S.-based expense management provider InterplX

Inc., securing in‑market software, support capabilities, and SaaS technology to

improve its travel‑and‑expense offering across the region.

FEBRUARY

Corporate travel demand starts 2019 strong, with major U.S.

carrier reporting large year-over-year increases in business bookings and

showing optimism despite macroeconomic concerns.

Lufthansa initiates biometric boarding at Miami International Airport. This

would enable passengers to use facial recognition cameras to board flights in

under two seconds. The carrier plans to take the project to more U.S. airports

and add biometric terminals.

With outcomes uncertain two months before the U.K.’s planned

departure from the EU, travel managers face major planning challenges. They take limited precautions amid

concerns of travel disruption, cost surges, and regulatory changes in

case of a no-deal Brexit.

American Express Meetings & Events expands its Meetings Marketplace through partnerships with mobile app

Attendify and registration website builder Splash.

Aventri uses VenueBook’s direct booking technology to

revamp its strategic meetingsplatform. It would allow event planners

to source, negotiate, and book non-traditional venues directly in Aventri’s

dashboard.

United Airlines—with the Airlines Reporting

Corporation; a large corporate client; and Blockskye—has successfully tested a blockchain-based reporting and settlement system for direct

flight bookings. They would eventually like to expand live testing and include

other airlines and suppliers.

Cvent CEO Reggie Aggarwal talks to BTN about his

company’s plans to apply AI and blockchain technologies into corporate travel

and event management.

MARCH

In the event of a no-deal Brexit, the U.K. and EU have

agreed to continue air travel rights through March 2020. This news

eases concerns for around 164 million air passengers between the U.K.

and EU member states each year.

Industry experts observe that hotel firms are rapidly

launching and acquiring new brands to fill gaps in service and pricing tiers,

target diverse travelers, improve loyalty programs, and extend their

global reach.

United Airlines launches a meetings portal within its Jetstream platform for corporate

clients to quickly access flexible discounts, automatically apply transient

agreements, track related bookings, and earn amenity funds for attendee travel.

Certify and Chrome Riverhave merged under a new $1 billion+ holding company backed

by K1 Investment Management. They serve both SMBs and large enterprises

while maintaining separate brands to better compete with industry leader Concur.

Abacus creates Abacus Travel, a booking tool offering flights, hotels, cars, and rail, to

allow for real-time policy compliance and seamless expense tracking. It’s the

company’s first major product launch under its parent, Certify.

Amex GBT introduces a suite of tech upgrades,

like a benchmarking tool that features traveler well-being

metrics, AI-powered booking recommendations, and hotel re-shopping.

APRIL

Fragmentation and consumerization drive travel management companies like Amex GBT, BCD,

and CWT to invest more in innovation and partner with startups to

deliver custom solutions for business travel programs.

Airbnb’s sizeable investment in India-based OYO Hotels strengthens

both companies’ expansion in fast-growing Indian and Chinese markets, raises

competition with traditional hotels, and boosts OYO’s corporate travel segment

aligned with Airbnb for Work.

Delta aims to resume operations in London Gatwick in 2020 with flights from Boston and JFK,

while its partnership with Korean Air adds new flights between the U.S. and

Asia. However, COVID-19 delayed those plans to May 2023.

TravelBank has released a new flight shopping display based on Next Generation

Storefront standards that uses ATPCO’s star ratings to provide travelers with a

more transparent sorting of fares by class, restrictions, amenities, and price.

Washington State Senate passes a bill that grants consumers rights to access,

correct, and delete personal data, while imposing obligations on businesses to

adopt reasonable security practices and allowing the Attorney General’s Office

to enforce violations, with civil penalties up to $7,500 per violation.

After recently signing a partnership deal with Amex GBT,

travel management startup Lola gets $37 million in Series C funding to double its workforce and focus

on tech development.

Boeing 737 Max aircraft remains grounded for several more weeks as Boeing upgrades

its anti-stall software pending FAA review. North American airlines continue to

adjust their schedules and deploy alternative aircraft to cover affected

flights.

BCD and CWT are each moving their fragmented

energy, resources, and marine (ERM) travel content and support into centralized global platforms. Amex GBT also strives

to deliver a consistent global ERM platform, which it believes will help with

scalability.

MAY

ATPCO’s Next Generation Storefront (NGS) standard, designed to help

airlines better display and differentiate fare options through third-party

channels, is gaining traction. Delta leads the adoption efforts, while

industry figures debate refinements like alternatives to the current star-based

rating system.

Travel and payment providers advance the use of virtual cards through mobile wallets. The industry moves

toward standardization, broader NFC adoption, and improving reliability and

back-office processes.

SAP Concur faces leadership and organizational changes. Jim Lucier becomes company president, as Mike Eberhard retires. Additionally, Christal

Bemont advances to the role of chief revenue officer.

U.K.-based Corporate Traveller has partnered with BitPay to become the U.K.’s first business TMC to let

SME clients pay for bookings with bitcoin and bitcoin cash, settling payments

within two business days.

Travel startup Pana raises $10 million in Series A funding to develop its focus on

guest travel, especially for job candidates and other non-employee travelers.

Pana seeks to combine its technology and offline agent support, deepen TMC

partnerships, and explore use cases like small meetings and events.

JUNE

Controversy ensued for corporate travel groups ACTE and GBTA in appointing new executives from within their boards. Those in

the industry think about conflicts of interest, governance transparency,

and potential fallout in member trust and event attendance.

Strong Customer Authentication (SCA) rules taking effect in

the European Economic Area on September 14 are expected to disrupt corporate

travel payments, specifically those involving plastic cards. This is due to

complex, country-specific interpretations, with virtual and lodge cards likely

less affected but still facing uncertainty.

InterContinental Hotels Group debuts Atwell Suites, an upper-midscale, all-suites brand

targeting “opportunity seekers” blending business and leisure travel,

with a 50/50 guest mix and amenities positioned between extended-stay and

select-service hotels. IHG also rolls out updated designs for Holiday Inn,

Staybridge Suites, and Candlewood Suites.

Hobo Hotel completes the first hotel booking on a public blockchain using Winding Tree’s platform.

It shows advancements toward decentralized, secure, and open-source travel

distribution, with support for fiat, credit, and cryptocurrency payments.

Mint House, a tech-driven, apartment-style

hospitality startup for business travelers, raises $15 million in Series A

funding to introduce its short-term rental model into 10 new U.S. cities,

vying to become a trusted corporate lodging alternative to traditional hotels and

Airbnb.

JULY

Several airlines pilot the International Air

Transport Association’s New Distribution Capability standard with select TMCs to

enable more personalized, retail-like fare and ancillary distribution. They aim

for wider adoption and “critical mass” by 2020.

India-based OYO Hotels & Homes wants to invest $300 million in the U.S. to scale its hotel

footprint, talent, and infrastructure. They’re backed by Airbnb, SoftBank

Vision Fund, Greenoaks Capital, Sequoia and Hero Enterprise.

Canada’s new Air Passenger Protection Regulations require airlines to

compensate passengers up to $2,400 for flight disruptions within the carriers’

control—applying to all flights to, from, and within Canada—while exempting

delays or cancellations caused by safety-related mechanical issues.

Deem announces it will discontinue its Deem Expense system, transitioning clients

to Certify. Meanwhile, the company will keep focusing on its Work Fource travel

platform and integrating with various expense providers via its Open Expense

Alliance.

American Airlines and Qantas have received

tentative U.S. DOT approval for their long-awaited joint venture, enabling revenue sharing and coordinated

services between the U.S. and Australia/New Zealand. New routes and deeper

integration are being planned, pending final approval after public commentary.

With the Boeing 737 Max being grounded since March 2019, a recent

GBTA survey reveals that travelers and buyers are worried about flying the

aircraft once it returns to service. TMCs and booking platforms offer aircraft

type data at point of sale so that users can implement profile preferences

or policy rules. But aircraft swaps close to departure could still happen, and

most companies haven’t yet changed policies to block 737 Max bookings.

AUGUST

More travel managers struggle with hidden resort fees, as attorneys general in all 50 states and DC

investigate the growing use of “drip pricing.” Legal action against Marriott spotlights deceptive practices, yet the fragmented hotel ownership structure

and limited regulatory involvement leave managers to rely on traveler vigilance

amid ongoing market and platform efforts to raise transparency.

Venue options for meetings have been shifting from traditional hotels towards

flexible, purpose-built spaces and tech-enabled platforms. Instead of directly

competing with them, hotels continue to invest in and collaborate with

alternative venues. BTN speaks with three meetings professionals about their

sourcing strategies.

British Airways receives a £183.39 million fine

from the U.K. Information Commissioner’s Office (ICO) for a 2018 data breach that compromised nearly 500,000 customers’

personal data via a fraudulent site redirect. Following that, ICO

declares a proposed $123 million fine against Marriott

International for a data breach coming from Starwood systems, which Marriott failed to detect

post-acquisition. Ultimately, that incident compromised the personal data of

339 million customers, including 30 million in Europe.

The prolonged Boeing 737 Max grounding intensifies questions across the

airline industry about global regulatory trust, operational complexity, and

passenger confidence. Airline executives warn that inconsistent international

approvals could undermine the aviation system’s credibility, and business

travelers are already hesitant to choose the aircraft type.

France plans to have an “eco tax” of €1.50 to €18 on outbound flights starting in

2020. The move draws criticism from Air France, which argues the tax

will affect competitiveness without directly supporting aviation

sustainability. Analysts note it aligns with a growing European trend of taxing

air travel for environmental reasons.

SEPTEMBER

Southwest Airlines says that by mid-2020, it will

begin offering full booking capabilities in GDSs through new agreements with Travelport and Amadeus.

SAP Concur’s A.G. Lambert explores how AI transforms corporate travel. In an op-ed, he notes

how AI is balancing cost control and employee satisfaction, automating tasks,

enhancing compliance, and enabling personalized travel experiences for both

travelers and managers.

Corporate hotel rate negotiations for 2020 are swaying in

buyers’ favor due to slowing ADR growth. Buyers are pushing for lower rate

increases, targeting hidden fees, and leveraging alternative lodging options

like Airbnb for negotiating power against still-strong but stabilizing hotel occupancy.

Hotel giants Accor, Hilton, IHG, and Marriott’s joint $50

million investment in meetings tech platform Groups360 has raised antitrust concerns over potential collusion, exclusivity,

and data sharing. Groups360 emphasizes it has safeguards in place to

protect sensitive pricing data and prevent anti-competitive behavior.

European business travel stakeholders brace for the

potential disruptions intended to start on September 14, 2019 as Strong Customer Authentication (SCA) becomes mandatory for

e-commerce payments in the EU. They believe added verification requirements may

complicate corporate travel bookings despite some exemptions, grace periods,

and ongoing upgrades to authentication protocols like 3DS.

BCD Travelpurchases long-time affiliate Adelman and wants

to keep it as a standalone operation with its current leadership.

Following a series of acquisitions, U.K.-based Reed &

Mackay buys Business Travel Direct as part of its strategic growth. The subsidiary would run as a

stand-alone business under managing director Julie Oliver for that time.

OCTOBER

Several sources familiar with Googles’ plans told The

Beat the search giant had plans

to enable corporate identifiers on Google Flights, thereby allowing

business travelers to shop corporate negotiated fares on the metasearch.

However, those predictions did not materialize.

JetBlue prepares to take on the “obscene” premium

fares between the U.S. and London as the carrier prepares

to launch its first European flights in 2021, which it did do in August 21.

Delta Air Lines and Latam announce

partnership, with Delta

taking a 20 percent stake in the Brazilian airline. Latam exited its previous

partnership with American Airlines the Oneworld alliance. The partnership will

built on Delta’s joint venture with AeroMexico, further connecting North and

Sound America. Delta will exit

stake in Gol by December.

Facial

recognition and biometric identifiers become the vision of future traveler

mobility across airports and border crossing, immigration processes. The World

Travel & Tourism Council identified 53 efforts in play in 2019 to

implement biometrics across the U.S., Southeast Asia, the EU and the Caribbean.

NOVEMBER

American and Southwest airlines push

back Max 737 return to March, after previously suspending service on the Boeing

aircraft until February 8.

BCD Travel opens its SolutionsSource

technology marketplace to developers at “authorized” third-parties. The

upshot is that marketplace members have access to the same APIs BCD uses to

power its own core solutions and, therefore, can develop deeper integrations.

Ohio-based travel management company ATG uses natural

language processing, data retrieval, automated reasoning and machine learning

capabilities of IBM

Watson to deliver booking recommendations.

United Airlinesannounces

plans to pursue Brazilian carrier Azul and bring it into a four-way joint

venture partnership with Avianca and Copa, as United sees opportunity in

Latam leaving its AA partnership. The carrier also increased its regional

service within the U.S. via two-cabin, 50-seat Bombardier CRJ-530s.

Accorexpands

its co-working brand Wojo, which it launched in 2015, beyond France and

into Barcelona. Accor had plans to create 1,200 Wojo locations in Europe by

2022. The Covid-19 pandemic will de-rail that plan, but Wojo as of 2024 had 400

locations.

JetBlue

and Norwegian plan to interline; however, the move never materialized.

Norwegian changed its strategy after Covid-19 to operate mostly short-haul

flights within Europe.

IAG inks agreement to buy Spanish

airline Air Europa for 1 billion euros with plans to build Madrid into a European

hub. The acquisition plan is scrapped in 2021and re-upped in 2023 and fully abandoned

2024.

DECEMBER

United CEO Oscar Munoz announces plans to step down

in May and be replace by then-United president Scott Kirby. He had taken

the reins in 2015 after a federal corruption investigation of prior CEO Jeff

Smisek. Munoz’s early tenure faced serious challenges highlighted by a heart

transplant surgery and viral video of the airline forcibly removing Dr. David Dao

from a flight. After that, however, United

saw a significant turnaround under Munoz and Kirby, strengthening its

network from its hubs and improving operational and financial performance

ARC CEO Mike Premoannounces

plans to retire at end of 2020; Lauri Reishus, then-executive VP and

COO, succeeded him as the first female CEO of ARC.

American Express Global Business Travel president Philippe

Cherequeannounces

plans to depart the organization by end of March 2020 to join Certares, the

investment company that led private equity group that holds a 50 percent stake

in GBT. Andrew Crawley slated to join Amex GBT in the newly created role

of chief commercial officer in April.

By the end of 2019 TripActions, TravelBank, Upside,

Psngr1, WhereTo and AmTrav each had adapted the Next

Generation Storefront standard to their booking displays. Next Generation

Storefront was announced in late 2018 and led by ATPCO, but with major booster

Delta Air Lines, which leveraged its content with emerging players in order to

drive adoption.

A cluster of mysterious

pneumonia cases, mostly in the Hubei province of China, was first reported

to the local government on Dec. 27, 2019 and published on Dec. 31. Some

airports in Asia begin screening passengers for fevers prior to boarding and upon

arrival.

_______________________________________________

Editor’s Note: Monthly highlights were composed by BTN editorial engagement manager Gianna Song with the help of AI tools.

_______________________________________________

Elizabeth West is the vice president of Content for the

BTN Group. She has reported on the business travel and meetings industries for

24 years. Beth was editor-in-chief of Meeting News from 2006 to 2008 and

director of content solutions for ProMedia Travel from 2008 to 2011, when

ProMedia was acquired by Northstar Travel Media and merged with BTN. She became

editor-in-chief of BTN in 2015 and editorial director of the BTN Group in

2019.